I‘m asked daily, “What is the future of real estate?” or some similar version of that question. It seems to be a hot topic these days, and for good reason. If you catch even a brief snippet of a news headline, it will likely include some speculation of the future of real estate. The reality is that the market is not expected to crash or behave like the housing crisis in 2008. We are likely to see a shift to a more “normal” or “balanced” real estate market. Overpricing is going to be very easy for a seller to do, as most comparable sales reflect a market that no longer exists. It’s imperative sellers are connected with a professional REALTOR® with a stout resume to ensure sellers are given the most up-to-date information regarding market trends. When you are actively in the middle of a market shift, the current market data won’t immediately reflect in statistics. Economists project approximately 20% fewer sales, but the overall market will still likely rank top 10 of market sales in historic reference. While inventory has climbed some, there is still a lack of inventory to meet demand.

My biggest tip is don’t focus on the unknown, focus on the facts we know today. The reality is that every honest economist projection includes words like “it depends” or “time will tell” about what the future holds. No one holds a crystal ball, and all signs indicate a cooling off, not a crash. Primary reasons are: continued low inventory, high equity position for homeowners, and lack of new construction to meet growing demand. High equity values in homes will make foreclosures rare. A homeowner will not “walk away” from a mortgage when they have equity in the home.

While rates have seen an uptick, they are in lower range of historic rates. The ’80s saw 15-18%, the ’90s saw 6-10% and the 2000s forward saw 5% or less until very recently. So it’s not just ’90s fashion trends that are back, their interest rates have returned as well.

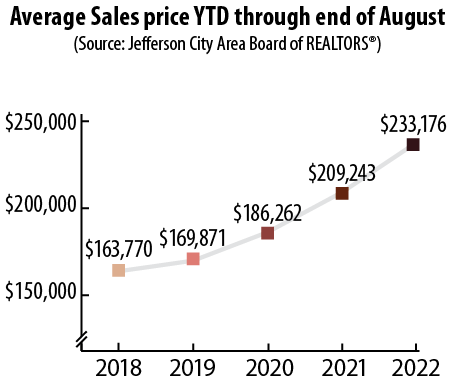

See the list of average sales price values reflecting the last handful of years. This showcases that even if the market cools off some, we are well above historic home values in this area. My team is closely monitoring up-to-the-minute market conditions and advising accordingly.